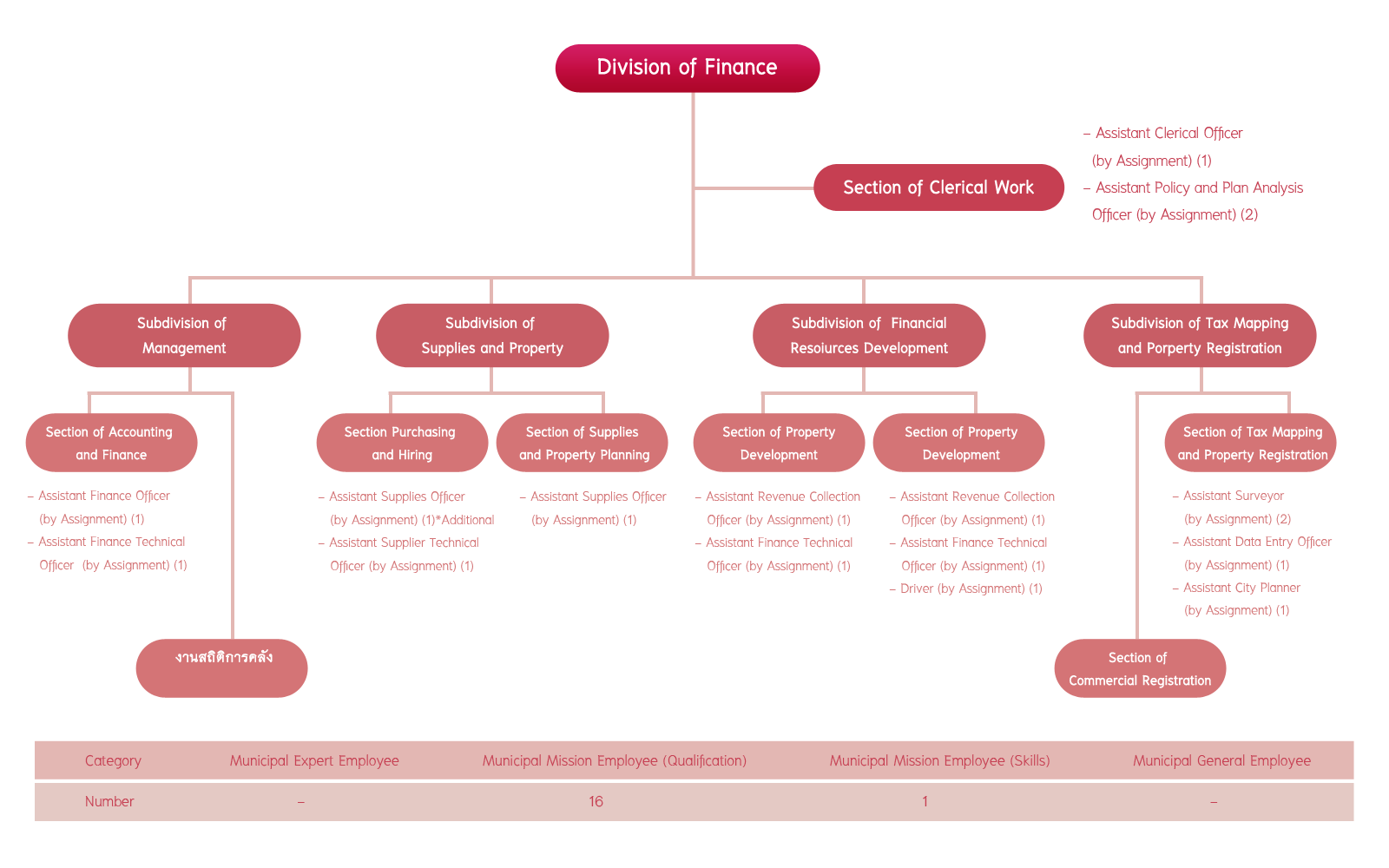

Division of Finance

Saensuk Municipal Office

Division of Finance takes responsibility in controlling revenue development.

- Section of Accounting and Finance

- Section of Property Development

- Section of Taxation

- Section of Revenue Collecting

- Section of Financial Statistics

- Section of Taxation Mapping and Property Registration

- Purchasing, Hiring, Bidding and other relevant assignments

- Receiving of Tax and Fee Payment

- Receiving of Building and Land Tax Payment

- Local Development Tax Payment

- Receiving of Signboard Tax Payment

- Receiving of Permission Fee for Use of Amplifier

Building and Land Tax

Building and Land Tax is tax that shall be collected from;

1. Building and Land used together with that building relatively and

2. Other structures built on the land that is relatively used with the building.

Building means houses, commercial buildings, shops, offices, banks, hotels, cinemas, hospitals, schools, residential flats or apartments, condominium, dormitory, boxing stadium, racecourse, warehouses and etc.

Other structures means ports, reservoir, gasoline tanks, dockyards of which the construction is permanently bonded with the land.

The meaning of land that used together with building or other structures is the land in which building or other structures have been built connectively and normally used together with such building or structure. Taxable person is the person to receive tax estimation, which means a person who is the owner of the asset.

Procedure of Payment for Building and Land Tax

Submission of Taxation Application

Taxpayer (owner of the asset) shall submit taxation form Por.Ror.Dor.2 within 28 February of every year.

Here is the list of evidence required to present.

Evidence required to present are as below;

1. Receipt of Building and Land Tax in Previous Year

2. Details of Total Numbers of Buildings Owned in the Area of Municipality

3. List of Land Area Owned in Each Piece of Land

4. Indentification Card

Building and Land Tax Assessment

Officer will estimate tax from annual rate, annual rate means amount of money that the asset could make money from rent in each year.

Revenue Rate of Building and Land Tax

Taxpayer shall pay tax in the rate of 12.5% of annual rate.

Payment

When taxpayer (owner of the asset) receives the notification of tax estimation (Por.Ror.Dor.8), the payment of tax has to be made at Section of Property Development, Division of Finance within 30 days after receiving of the notification.

Lodging an Appeal

In case taxpayer receives the notification but feel discontented in such tax estimation, please lodge an appeal for reconsideration of Building and Land Tax within 15 days after receiving of the notification. estimation

Overdue of Tax Payment

1. Overdue of 1 month from the deadline indicated by the law, 2.5% of additional charge calculated from pending tax amount.

2. Overdue over 1 month but not over 2 months from the deadline indicated by the law, 5% of additional charge calculated from pending tax amount.

3. Overdue over 2 month but not over 3 months from the deadline indicated by the law, 7.5% of additional charge calculated from pending tax amount.

4. Overdue over 3 month but not over 4 months from the deadline indicated by the law, 10% of additional charge calculated from pending tax amount.

Penalty

Anyone who ignores application of taxation for payment within the due date shall be wrong and entitled to the fine of not over 200 Baht.

Local Development Tax

Local Development Tax is the tax collected from land including the land area, mountain area or water area.

Procedure of Local Development Tax Payment

Owner of the land taking responsibility for tax payment shall submit application for tax payment (Por.Bor.Tor.5) at Property Management Section, Finance Division of Saensuk Municipality for the period of every 4 years.

In case of the person has become new owner of the land or the area of land has been changed, the owner shall submit Land Listing Form within 30 days from the day he or she has become the owner or area of land has been changed.

Tax Payment

Taxpayer shall make the payment of Local Development Tax within 30 April of every year.

Overdue of Tax Application Submission and Payment

In case of taxpayer doesn’t submit tax payment application within due date, overdue will be fined 10% additional charge of tax amount.

In case of taxpayer doesn’t make tax payment within due date indicated by the law, overdue will be fined 2% additional charge per month calculated from tax amount.

Deduction

A person who owns 1 piece of land or many in the area of Saensuk Municipality and use the land(s) as residence or farming purpose shall be allowed exemption of Local Development Tax for the land area of 100 Square Wah.

Signboard Tax

Signboard Tax is the collection of tax from use of signboard that presents brand’s name and logo used for commercial purpose or other business to create income or commercial advertisement of other business to create income. This is inclusive of the present or advertisement on any type of materials using pictures, letters, or symbols written or crafted or made by any methods.

Procedure of Signboard Tax Payment

Submission of Signboard Tax Payment Application

- Owners of Signboards shall submit taxation form Por.Bor.1 within 31 March of every year.

- In case of new signboard installation, the owners shall submit taxation form Por.Bor.1 within 15 days after new installation completed.

Signboard Category 1 means the signboard in which the whole language is presented in Thai will be charged 3 Baht for 500 Square Centimeters.

Signboard Category 2 means the signboard in which the language is presented in Thai and other foreign languages or pictures or other symbols will be charged 20 Baht for 500 Square Centimeters.

Signboard Category 3 means (A) the signboard in which the language presented has no Thai letter, even it contains any pictures or symbol or not. Or (B) the signboard in which the language presented has some Thai letters or the whole sentence but placed under letter of foreign languages, it will be charged 40 Baht for 500 Square Centimeters.

After calculation of signboard area and the tax amount is below 200 Baht, it shall be paid in amount of 200 Baht per one signboard.

Overdue of Tax Application Submission and Payment

- Owner of signboard who don’t submit the application within due date shall be entitled to the fine of 10% of tax amount.

- Owners of signboards who don’t pay tax within due date shall be entitled to the fine of 2% of tax amount.

Fee for Garbage Collection and Moving

For building where daily garbage is over 20 liters, fee shall be 20 Baht.

For tidiness of the building and benefit to cleanliness in area of Municipality, please provide your cooperation for payment of garbage collection and moving fee in every month. And please ask for receipt from the officer every time you pay.